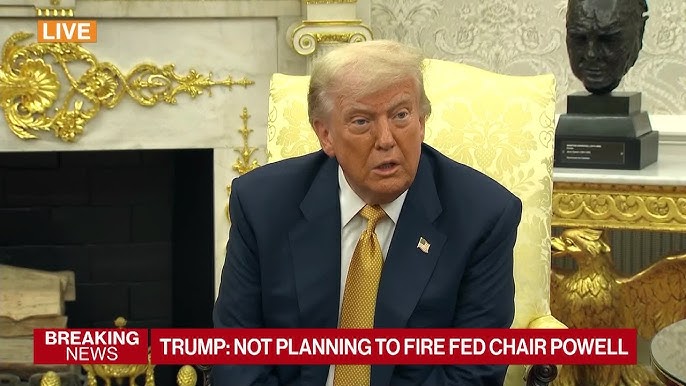

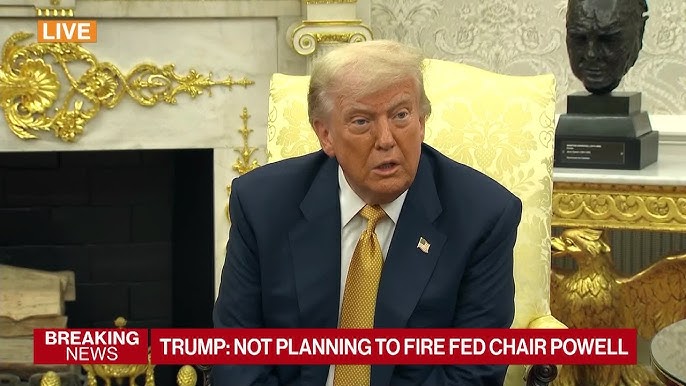

Trump and Federal Reserve Chairman Powell: A Political and Legal Crossroads

The debate over President Trump’s remarks concerning Federal Reserve Chair Jerome Powell has reignited long-standing questions about the balance of executive power and the legal limits imposed on presidential authority. In a twist and turn that has surprised some and reassured others, Trump’s recent statements both hinted at a potential removal and, moments later, downplayed such a move as “highly unlikely” unless evidence of fraud emerges. This editorial will dig into the situation from multiple angles, examine the legal framework that governs these actions, and assess the potential political and financial consequences of any drastic steps.

In recent meetings with federal lawmakers, details emerged that fueled speculation in political circles and across the media. On one side, a senior White House official and reports from respected sources suggested that Trump had expressed openness, even willingness, to take action against Powell after gauging support among House Republicans. On the other, Trump immediately downplayed this possibility, stressing that while he did not rule out the option entirely, dismissing Powell was not on his active agenda unless a sufficient cause—such as possible fraud related to significant projects—is proven.

Understanding the Legal and Constitutional Boundaries

The conversation surrounding the potential firing of a central banker is not only a political hot potato but also a legal minefield. Traditionally, the Federal Reserve Chair has been appointed for a term that insulates the office from abrupt and politically motivated removals. Indeed, no previous president has ever attempted to remove the country’s top central banker without triggering a significant legal challenge.

Legal experts insist that the president’s authority in this arena is heavily circumscribed by laws established over decades. The Supreme Court’s recent decision reaffirmed that the president is not allowed to remove Fed officials at will, ensuring that any such action is constrained by statutory protections. The discussion, accordingly, extends beyond mere political theater—it raises essential questions about the boundaries of executive power in a system built to withstand shifting political winds.

Comparing Historical Precedents and Constitutional Safeguards

One of the key issues is the contrast between bypassing established legal procedures and the reliance on constitutional safeguards developed to handle complicated pieces of governance. While political pressures and public statements may suggest an imminent showdown, historical precedent underscores that the legal structures in place are designed to get around ephemeral political trends.

Below is a summary of the key legal and historical points in table format:

| Aspect | Historical Practice | Legal Constraint |

|---|---|---|

| Presidential Removal of Federal Officers | Rarely attempted, with considerable caution | Protected by statutes and backed by Supreme Court rulings |

| Federal Reserve Independence | Maintained over several administrations | Legally insulated to prevent politicization of monetary policy |

| Criteria for Dismissal | Historically minimal interference | Requires clear evidence of wrongdoing (such as fraud) |

Political Ramifications and the Messaging Game

Even as legal experts and constitutional scholars maintain that any effort to fire Powell may run into serious court battles, political strategists keep a keen eye on the messaging delivery from both sides. Trump's contradictory remarks—initially suggesting that he might soon follow through with the removal, only to later label such action as “highly unlikely”—create a confusing environment for political analysts and voters alike.

This mixture of statements illustrates the difficult balance of trying to mobilize a political base while ensuring that actions taken remain within legal limits. The public discourse is full of subtle details and small distinctions that, when not clearly communicated, can lead to misinterpretations among supporters and detractors alike.

Key Talking Points for Politicians and Analysts

- Balancing Act: Politicians must weigh the need for a strong stance against potential legal repercussions.

- Messaging Consistency: Consistent communication is critical when navigating tricky parts of political debate on executive authority.

- Influence on Markets: Financial markets are very sensitive to remarks that might indicate instability at a crucial institution like the Federal Reserve.

- Legal Consultations: Advisors and legal experts stress on looking into the fine points of statutory and constitutional limitations before any drastic action is taken.

Market Reactions and Economic Implications

The potential firing of Federal Reserve Chair Powell goes beyond political theater—it has a reverberating effect on financial markets. Initial reports of Trump’s intent to dismiss Powell sent shockwaves across trading floors, leading to a temporary dip in market values until clarifications were issued. Investors, regulators, and financial advisors are particularly concerned about the possibility of changes in monetary policy, which could introduce nerve-racking volatility into an already unpredictable market landscape.

Critics of Federal Reserve policies, including some prominent Republicans and even dissenting Fed officials, have long argued that Powell's approach may be too conservative in addressing economic challenges. However, defenders claim that Powell’s commitment to an independent and insulated policy framework is crucial for preserving long-term economic stability in a constantly shifting global economy.

Market Reaction Timeline: A Closer Look

The sequence of market responses following the initial reports can be broken down into several phases:

- Initial Shock: A sudden downturn when the rumor of Powell’s imminent dismissal surfaced.

- Clarification and Recovery: Markets recovered as Trump clarified his stance and downplayed the likelihood of firing Powell unless fraud is demonstrated.

- Ongoing Volatility: Uncertainty remains, and investors are watching closely for further indications of policy change or hints at executive interference in central banking.

This timeline reinforces the delicate interplay between political declarations and market responses, where even offhand remarks can trigger a chain reaction of cautious trading and repositioning by investors.

Interpreting the Executive’s Dual Message

One of the most intriguing aspects of this saga is the president’s dual messaging. On one occasion, during an Oval Office meeting with House Republicans, it appeared that Trump was prepared to take action against Powell. After gauging the approval of key members, he even went so far as to hint at a swift resignation, should certain conditions be met. Yet, in subsequent interviews and official statements, he portrayed the dismissal of Powell as a remote possibility.

This contradictory communication raises several questions. Is the president testing the waters to see what his allies might support? Or is this a deliberate strategy aimed at signaling a tough stance on fiscal policy while ensuring that a full-fledged legal battle is avoided? The answer may lie in analyzing both the immediate political context and the broader historical underpinnings of central bank independence.

Dissecting the Messaging Strategy

The dual nature of Trump’s comments can be thought of in the following ways:

- Testing Political Support: By initially mentioning the possibility of dismissal, Trump may be trying to rally certain factions within his party who are dissatisfied with current economic policies.

- Legal Safe Guarding: The subsequent softened stance indicates awareness of the limits imposed by law. Any overt attempt to dismiss Powell without legal backing could result in extended court battles and political fallout.

- Market Manipulation: Recognizing the potential impact on financial markets, the president may have leveraged this dual messaging to influence market perceptions—however fleetingly.

This messaging strategy, intentional or not, leaves room for multiple interpretations and invites viewers and analysts to dig into the fine points of not only political tactics but also the underlying legal parameters at play.

Executive Authority Versus Statutory Protections

At the heart of the ensuing debate is the perennial conflict between the scope of presidential authority and the statutory protections that shield certain key positions from arbitrary removals. Federal Reserve Chair Powell’s tenure is symbolically enshrined as one of financial independence—a quality that is crucial for the stability of monetary policy in turbulent times.

Legal scholars and constitutional lawyers emphasize that once a nominee is confirmed by the Senate, the framework that supports independent monetary management should ensure that political interference is minimized. Removing Powell solely based on political calculations would not only be legally questionable but also politically divisive, potentially undermining investor confidence and destabilizing market dynamics.

Balancing Executive Influence and Independent Governance

The balance between executive influence and institutional independence can be broken down into several key areas:

- Appointment Versus Dismissal: While the president holds the power to nominate individuals for these crucial positions, the authority to remove them is limited by legal constraints and requires clear justification.

- Need for Transparent Criteria: Any attempt to dismiss a central banker must be accompanied by a transparent review process—one that can withstand judicial scrutiny and public debate. This helps safeguard the integrity of the institution.

- Long-Term Impact on Policy: The perception of a politically driven central bank could lead to uncertainties about future monetary policy, impacting everything from interest rate decisions to international financial relations.

An illustrative table below captures the key differences between appointment and dismissal processes:

| Aspect | Appointment Process | Dismissal Process |

|---|---|---|

| Authority | Executive nomination followed by Senate confirmation | Heavily limited, requiring statutory justification |

| Legal Framework | Guided by constitutional and legislative norms | Subject to strict legal scrutiny and judicial review |

| Political Considerations | Often influenced by policy alignment with the current agenda | Must balance political motives with institutional stability |

Assessing the Financial and Economic Consequences

Beyond the legal and political discourse, the uncertainty around Powell’s future has real implications for the economy. Investors, economists, and market analysts are acutely aware that central bank leadership plays a key role in shaping financial markets, influencing interest rates, and guiding monetary policy. Any perceived threat to the independence of the Federal Reserve could cause significant market jitters, especially during an already challenging economic period.

Market participants must now figure a path through a tangle of confusing bits in policy signals. The president’s suggestions of firing Powell—if taken seriously—could spur a chain reaction: shifts in interest rates, changes in borrowing costs, and even a reevaluation of the Fed’s role in economic recovery.

Potential Economic Impacts at a Glance

Some of the likely economic scenarios resulting from these developments include:

- Interest Rate Volatility: Uncertainty about central bank leadership might prompt sudden adjustments in interest rate expectations, both domestically and globally.

- Investor Caution: Investors may become more cautious, adjusting their portfolios to mitigate risks associated with unexpected shifts in monetary policy.

- Market Sentiment: Conflicting messages in the political arena have the potential to alter market sentiment, creating temporary downturns or rebounds as speculation continues.

- Policy Repercussions: Any attempt at executive overreach could force the government to rethink the session’s balance between ensuring fiscal stability and maintaining institutional independence.

Reflections on the Future of Central Bank Independence

This saga also prompts a broader reflection on the future of central bank independence as an institution. As governments face growing pressure to exhibit proactive control over monetary policy, the risk of political intervention increases. The current scenario underscores a critical point: despite the president's public statements, the legal and constitutional framework is designed to ensure that financial institutions remain insulated from short-term political shifts.

In an era marked by nerve-racking geopolitical changes and an ever-evolving economic landscape, maintaining trust in institutions such as the Federal Reserve is more essential than ever. The long-term success of monetary policy hinges on an environment where decisions are made based not on fleeting political calculations but on strategic, measured analysis.

Why Independence Matters

The independence of the Federal Reserve impacts a wide range of stakeholders:

- Investors: Rely on predictable and well-grounded monetary policy frameworks to make long-term decisions.

- Global Markets: International investors and foreign governments expect stability from U.S. financial institutions to maintain confidence in global trade and finance.

- Economic Growth: Stable monetary policy is critical for sustainable economic growth and for preventing runaway inflation or deflation.

- Public Trust: Independence helps build public trust by ensuring that economic decisions are insulated from partisan pressures.

Looking Ahead: The Road to Clarity and Stability

With the debate unfolding in real time, one thing remains clear: the delicate balance between political strategy and legal constraints is at the forefront of this controversy. As the administration continues to process internal debates, lawmakers on all sides are poised to watch for further signals on the president’s next steps. What many agree on is that any movement on this front will be accompanied by intense scrutiny, both in the media and in the halls of Congress.

For now, President Trump’s mixed messages serve as a reminder of the challenges involved in balancing the practical demands of political maneuvering with the need to adhere to the established legal framework. Whether it be in discussions, interviews, or policy planning sessions, the remarks call on all involved to figure a path through the tangled issues of executive power and central bank independence.

Key Considerations for Future Policy Decisions

Looking forward, policymakers need to keep several points in mind as they adjust to the shifting political landscape:

- Adherence to the Rule of Law: Ensuring that any significant policy change is grounded in a clear legal framework is critical.

- Transparent Communication: Maintaining open channels of communication with both lawmakers and the public can help ease some of the overwhelming uncertainty associated with the current debate.

- Collaborative Decision Making: Engaging in thorough consultations with economic advisors, legal experts, and other stakeholders can help avoid missteps in future policy decisions.

- Long-Term Policy Stability: Emphasizing policies that are designed for longevity rather than short-term gains will be essential in protecting both domestic and international confidence in financial markets.

Conclusion: A Moment to Reflect on Institutional Integrity

The recent statements by President Trump regarding the possible firing of Federal Reserve Chair Jerome Powell offer a window into the multifaceted nature of American governance. They expose the intricate interplay between political strategy, legal boundaries, and the economic implications that ripple across the financial markets. While initial remarks stirred concerns about potential drastic moves, the subsequent clarifications underscore the limitations imposed by the rule of law on even the highest offices in the land.

It is incumbent upon both the administration and Congress to work through these tricky parts by steering through the challenging bits of political rhetoric and ensuring that any future moves uphold the essential principles that have long safeguarded the independence and stability of the Federal Reserve. By taking the wheel of governance with an approach that balances political pressures with legal obligations, policymakers can help sustain investor confidence, promote economic stability, and protect the established norms of American civic life.

In these tense times, this episode serves as a critical reminder of the need to find your way through political maneuvers while respecting the super important legal frameworks that have been constructed to shield key institutions from undue influence. As we collectively observe these unfolding events, it is vital to keep a keen eye on both the legal fine points and the small distinctions in language that, together, shape our national policies and the enduring trust in our financial institutions.

Final Thoughts

To summarize, the controversy surrounding President Trump’s remarks about firing Fed Chair Powell is emblematic of the broader dialogue about executive reach versus institutional separation. While political rhetoric may occasionally appear loaded with tension and ambiguous signals, the legal system remains a steadfast guardian of processes that have been refined over decades. In this delicate balance, ensuring that decisions are made based on transparent legal criteria, and not merely partisan considerations, remains a must-have for the continued success and stability of the nation’s economic policies.

As this debate continues to unfold, and as political actors dig into the fine shades of language and legal precedent, it is essential for commentators, policymakers, and citizens alike to stay informed, ask critical questions, and encourage practices that further solidify the independence of essential institutions. Only by doing so can we work toward managing our way through the intricate twists and turns of modern governance while preserving the integrity that underpins both our financial markets and democratic traditions.

Originally Post From https://www.cnbc.com/2025/07/16/trump-powell-fed-fire.html

Read more about this topic at

Trump denies that he plans to fire Powell: 'Highly unlikely'

Trump lashes out at supporters over Jeffrey Epstein files ...

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.